How to create a diversified investment portfolio

The Importance of Diversification in Investing

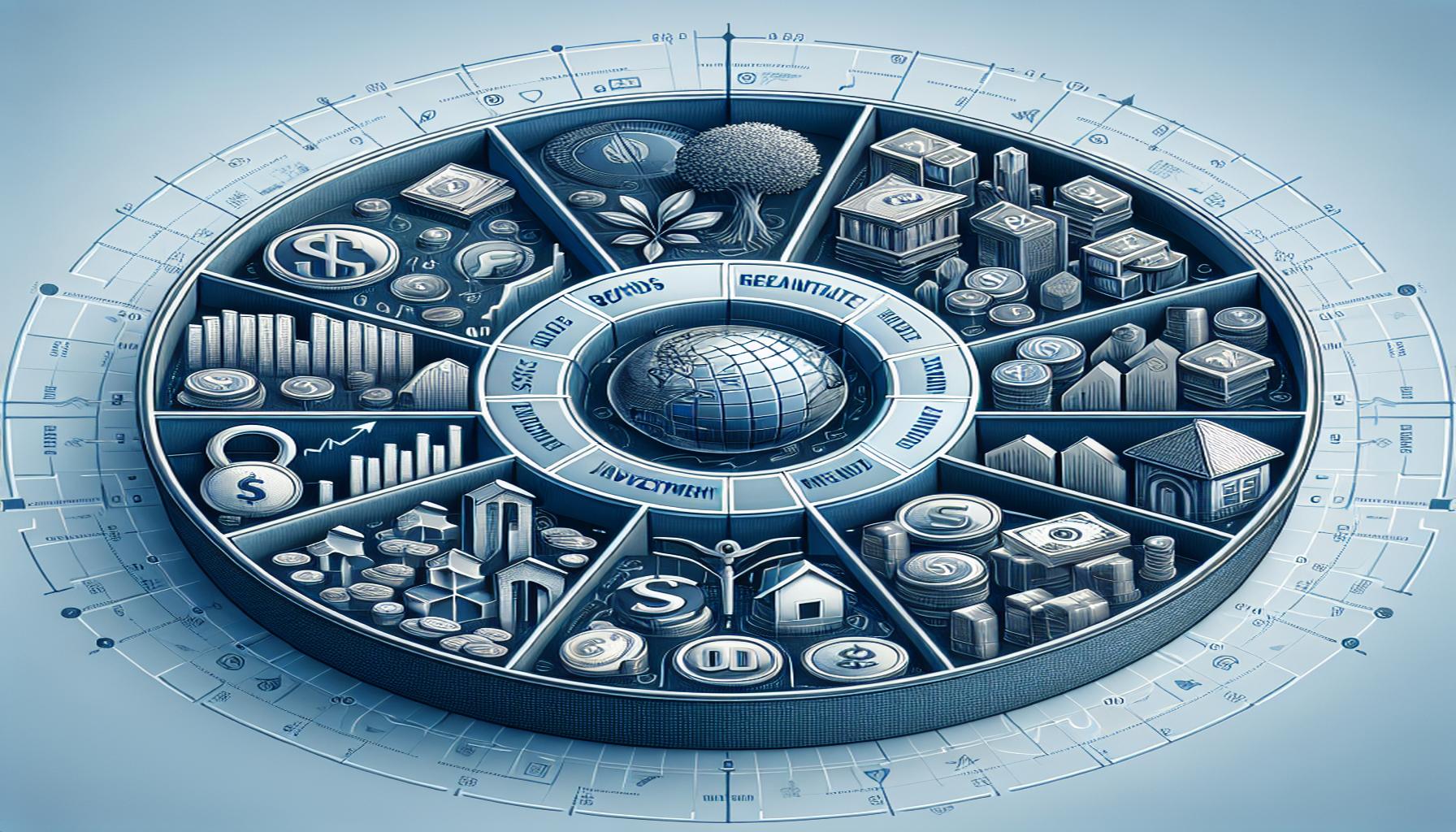

Investing can feel daunting, especially with the myriad choices available in the market. However, diversifying your investment portfolio is a crucial strategy that can help manage risk and enhance potential returns. By spreading your investments across different asset classes, you can protect yourself against market fluctuations.

Understanding Asset Classes

When we discuss asset classes, we are referring to categories of investments that exhibit similar characteristics and behave similarly in the marketplace. These typically include stocks, bonds, real estate, and commodities such as gold or oil. For example, stocks tend to offer higher potential returns but come with increased risk due to their volatility. On the other hand, bonds are generally seen as safer investments but often provide lower returns over time. By including a variety of these asset classes in your portfolio, you can create a balance that suits your risk tolerance and investment goals.

Geographic Diversification

Geographic diversification is another layer of safety in investments. It involves including assets from different regions—such as Canada, the United States, and emerging markets. For instance, if the Canadian economy faces a downturn, investments in other regions could perform well and help cushion your overall returns. An example would be investing in U.S. tech stocks while also holding Canadian real estate. This geographical spread ensures that you are not overly reliant on the economic performance of a single country.

Sector Diversification

Sector diversification refers to spreading your investments across various industries and sectors. Imagine having investments in technology, healthcare, consumer goods, and energy. If the technology sector experiences a decline, your investments in healthcare or energy might still perform well, helping to reduce the impact of the downturn. For Canadians, sectors like natural resources or banking should not be overlooked, as they are pivotal in our economy.

The Benefits of a Diversified Portfolio

Consider this: if you invest only in one stock or sector, a downturn could lead to significant losses. However, a well-diversified portfolio—consisting of various asset classes and sectors—can help cushion you against such risks. For example, during the COVID-19 pandemic, many tech stocks surged while traditional retail faced significant challenges. A diversified portfolio would have allowed investors to weather that storm without suffering devastating losses. In this guide, we will explore practical steps and strategies to create a diversified investment portfolio tailored to your financial goals.

Conclusion

As you begin your investment journey, always keep in mind that diversification is not just about spreading your money; it is about crafting a strategy that helps manage risk while optimizing potential returns. Engaging with a financial advisor can also provide insights tailored to your unique situation, ensuring that your portfolio is both diversified and aligned with your long-term objectives.

Building Your Diversified Investment Portfolio

To effectively create a diversified investment portfolio, the first step is to set clear financial goals. Understanding what you want to achieve with your investments—whether it’s saving for retirement, funding a child’s education, or preparing for a major purchase—will guide your strategy. Goals will not only dictate how aggressive or conservative your portfolio should be but also help you determine the time frame for your investments.

Assessing Your Risk Tolerance

Your risk tolerance is pivotal in shaping a diversified portfolio. It refers to the level of risk you are comfortable taking with your investments. Factors influencing your risk tolerance can include your age, income, investment experience, and financial situation. Here are some key points to consider when assessing your risk tolerance:

- Age: Younger investors may lean towards riskier investments since they have more time to recover from market fluctuations, whereas older investors might prefer stability to safeguard their principal.

- Income: A stable income can allow for greater risk-taking, as investors may not rely solely on their investments for immediate financial needs.

- Investment Experience: Investors with more experience may feel comfortable navigating market volatility and investing in stocks, while those new to investing might prefer the security offered by bonds.

- Financial Situation: Assessing your existing savings, debts, and expenses will help illuminate how much risk you can afford to take.

Once you have a clear understanding of your financial goals and risk tolerance, the next step is to allocate assets accordingly. This involves determining the percentage of your portfolio that you will invest in each asset class. Generally, a suggested starting point could be:

- 60% in Stocks: This could include a mix of Canadian, U.S., and international stocks to gain exposure to various markets.

- 30% in Bonds: A portion in government and corporate bonds can provide a more stable income and lower volatility.

- 10% in Alternative Investments: This could involve real estate, precious metals, or other commodities to further diversify your risks.

Regular Portfolio Rebalancing

Creating a diversified portfolio is not a one-time task; it requires regular review and rebalancing. As market conditions change, the allocation of your investments may shift due to differing performance levels among asset classes. For instance, if your stocks perform exceptionally well, they might account for 70% of your portfolio instead of the intended 60%. This is a signal to sell some stock holdings and reallocate the funds to other underperforming assets, such as bonds or commodities, to maintain your desired risk-reward balance.

In summary, building a diversified investment portfolio starts with understanding your goals and risk tolerance, followed by strategic asset allocation and regular rebalancing. This careful approach will not only provide a safety net during market downturns but also enhance your growth potential over the long term, making your financial journey more rewarding.

Adjusting Your Portfolio During Life Changes

As life unfolds, your financial circumstances and goals may change, necessitating adjustments to your investment portfolio. Major life events such as marriage, the birth of a child, career changes, or nearing retirement can all impact your financial picture and, therefore, your investment strategy. Here is how to approach these changes:

Adapting to Major Life Events

Each significant event can shift your financial priorities. For instance, if you get married, you may want to start planning for a joint future, which could include buying a home or saving for children’s education. This may lead you to revisit your asset allocation:

- Family Planning: If you’re planning to have children, you might want to start setting aside funds in a registered education savings plan (RESP) or adjust your risk tolerance to ensure you’re able to meet upcoming expenses.

- Career Changes: A new job with higher or lower income can impact how much you can invest. A salary increase may allow for greater risk in your investments, while a decrease might necessitate a more conservative approach.

- Retirement: As you approach retirement, it’s crucial to shift towards more stable investments that provide income, such as bonds, to prepare for drawing from your portfolio to support your lifestyle.

Investing in Canadian Advantage

When building a diversified portfolio, it is vital to incorporate Canadian specific investments, which offer both growth potential and stability. The Canadian economy is driven by a handful of robust sectors, including natural resources, technology, and banking:

- Canadian Stocks: By investing in blue-chip companies like the Royal Bank of Canada or Canadian National Railway, you can tap into stable growth and consistent dividends, which can cushion your portfolio during economic downturns.

- Exchange-Traded Funds (ETFs): Canadian ETFs provide a convenient way to achieve diversification without needing to manage many individual stocks. Consider options like the iShares S&P/TSX Capped Composite Index ETF which offers broad exposure to Canadian equities.

- Real Estate: Canada’s real estate market can be a lucrative investment option. Consider Real Estate Investment Trusts (REITs) as they provide exposure to the market without the hands-on management of physical properties.

Tax Implications of Your Investments

Another crucial aspect of building a diversified portfolio is understanding the tax implications of your investments. In Canada, different assets are taxed at varying rates, which can significantly impact your net returns:

- Tax-Free Savings Accounts (TFSA): Investing through a TFSA allows your investments to grow tax-free, making it a beneficial tool for maximizing your portfolio’s growth potential.

- Registered Retirement Savings Plans (RRSP): Using an RRSP not only allows for tax-deferred growth but also provides immediate tax deductions on your contributions. This can help you save more aggressively for retirement.

By carefully considering these factors and being ready to adjust your investment strategy as your life circumstances evolve, you can ensure that your diversified portfolio remains aligned with your financial goals and risk tolerance. Remember, successful investing is a dynamic process that requires continued education and adaptability to changing conditions. Staying informed will empower you to make the best choices for your financial future.

Conclusion

Creating a diversified investment portfolio is not just a strategy; it’s a journey that adapts with you as your life circumstances and financial goals evolve. It’s important to remember that diversification helps spread risk, providing a cushion against market volatility while allowing for potential growth across various asset classes. From Canadian stocks and ETFs to REITs and tax-efficient accounts like TFSAs and RRSPs, understanding the various options available is key to building a sturdy financial foundation.

As you navigate major life events, regularly reviewing and adjusting your portfolio ensures that it aligns with your developing priorities. For instance, as your family grows or as you approach retirement, your approach to risk and investment allocation may need to shift in response to your changing needs. Embrace financial literacy and stay informed about market trends and economic factors affecting your investments to bolster your confidence and decision-making skills.

Ultimately, creating a diversified investment portfolio is about making informed choices that reflect your unique situation, fostering long-term success in achieving your financial aspirations. Each investment decision you make is one step towards securing your financial future, so take the time to educate yourself, adapt as necessary, and build a portfolio that best serves your goals.

Linda Carter is a writer and financial consultant specializing in economics, personal finance, and investment strategies. With years of experience helping individuals and businesses make complex financial decisions, Linda provides practical analyses and guidance on the World Information Now platform. Her goal is to empower readers with the knowledge needed to achieve financial success.